Author Archives: shashank punuru

Types of Solar Energy

Solar energy can be broadly classified into Photovoltaic solar power and Thermal solar energy. Solar thermal energy is the energy created by converting solar energy into heat whereas Photovoltaic solar power is the energy created by converting solar energy into electricity using photovoltaic solar cells.

Concentrating Solar Power is a new form of solar thermal energy in which power is generated by focusing reflected sunlight at a point. In Solar PV power is generated by photoelectric effect.

Their working can be seen here:

CSP is highly efficient when compared to Photovoltaic but the downside is that it is costly. However when used to generate large quantities of power CSP may be economical. Hence solar PV technology dominates all other types of solar energy. Now a days, Concentrated Photovoltaic (CPV) is also being used in which solar panels are parabolic and therefore, corresponding less land space is required; disadvantages include greater complexity of cell manufacture and price per kilowatt hour.

Current research in Solar PV technology:

Quantum dot solar cells are an emerging field in solar cell research that uses quantum dots as the photovoltaic material, as opposed to better-known bulk materials such as silicon, gallium . Quantum dots have bandgaps that are tunable across a wide range of energy levels by changing the quantum dot size. This is in contrast to bulk materials, where the bandgap is fixed by the choice of material composition. This property makes quantum dots attractive for multi-junction solar cells, where a variety of different energy levels are used to extract more power from the solar spectrum.

Type 2 Diabetes – Neural connection

What is Diabetes?

Diabetes / diabetes mellitus (DM) is a condition in which the body cannot properly store and use glucose for energy. To use glucose, the body needs a hormone called insulin that’s made by the pancreas. For some people with diabetes, the body becomes resistant to insulin. In these cases, insulin is still produced, but the body does not respond to the effects of insulin as it should. This is called insulin resistance. Whether from not enough insulin or the inability to use insulin properly, the result is high levels of glucose in the blood, or hyperglycemia.

People with diabetes are at greater risk for problems that involve damage to small blood vessels and nerves due to high levels of glucose in the blood. They are also at a greater risk of developing hardening of large arteries (atherosclerosis), which can result in a heart attack, stroke, or poor blood flow to the legs.

Types of Diabetes:

- Type 1 DM results from the body’s failure to produce insulin, and presently requires the person to inject insulin or wear an insulin pump. This form was previously referred to as “insulin-dependent diabetes mellitus” (IDDM) or “juvenile diabetes”.

- Type 2 DM results from insulin resistance, a condition in which cells fail to use insulin properly, sometimes combined with an absolute insulin deficiency. This form was previously referred to as non insulin-dependent diabetes mellitus (NIDDM) or “adult-onset diabetes”.

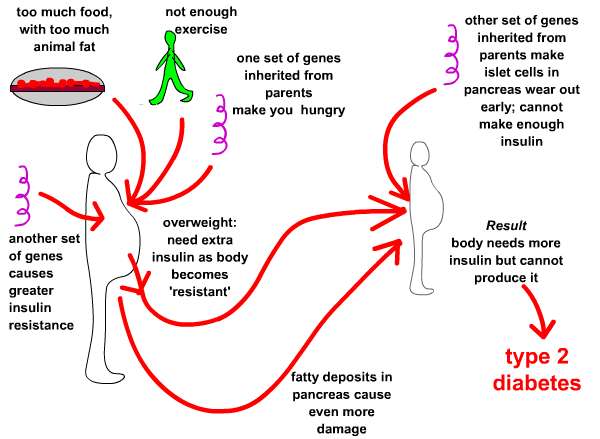

Type 2 diabetes makes up about 90% of cases of diabetes with the other 10% due primarily to diabetes mellitus type 1 and gestational diabetes. Rates of type 2 diabetes have increased markedly over the last 50 years in parallel with obesity: and India is the leading country with highest number of people with Type 2 diabetes. The causes of type 2 diabetes are shown in the following diagram:

Recent discovery of a gene by Indian Scientists:

The Indian Diabetes Consortium (INDICO), a Pan-India initiative led by CSIR-Institute of Genomics and Integrative Biology (IGIB) has recently discovered “TMEM163 gene” which encodes a probable vesicular transporter in nerve terminals. The study established a possible mechanism that the gene is responsible for impairing insulin secretion. . This effort places India to the list of countries which have the technology and human resource to perform high throughput complex genomic experimentation, at par with leading researchers in the developed world.

Sources:

wiki, bodyandhealthcanada.com, pib, medwebuk

Companies Bill 2012

Recently, the Lok Sabha passed the Companies Act 2012. It is hailed as a game changer in corporate governance. The bill gives more teeth to shareholders as they can take legal action against fraud. Also, it closes a window for independent directors as they won’t get any stock options.

The salient features of the Companies Bill are:

- The bill aims at improving corporate governance and it also contains provisions to strengthen regulations for companies and auditing firms.

- Although the bill does not precisely define what constitutes corporate social responsibility (CSR), it will mandatory for profit-making companies to spend on activities related to CSR.

- The act proposes to tighten the laws for raising money from the public. The move will hit chit funds. Only banking companies, NBFCs and other firms allowed by regulators will be permitted to accept deposits from the public.

- A director’s remuneration should not exceed five per cent of a company’s net profit. The new law also aims to strengthen corporate governance. It will be mandatory for independent directors to constitute at least one-third of the board.

- If a company winds up operations, it must pay two years’ salary to its employees.

- The legislation grants statutory powers to the Serious Fraud Investigation Office (SFIO) to tackle corporate fraud. The SFIO will get a big fillip once the legislation comes into force.

- The bill also bans buy back of shares within one year of the last buyback of shares.

- Audit firms cannot take up more than 20 assignments at any time. The appointment of auditors for five years to be ratified annually.

As the bill gives more teeth to shareholders, it boosts their confidence and hence economic growth.

Ethanol as motor fuel

Ethanol is most often used as a motor fuel, mainly as a biofuel additive for gasoline. Ethanol fuel is widely used in Brazil and in the United States, and together both countries were responsible for 87.1% of the world’s ethanol fuel production in 2011. The Clean Air Act requires the addition of oxygenates to reduce carbon monoxide emissions in the United States. Ethanol basically reduces CO emissions that affect ozone layer of the atmosphere.

What are advantages of ethanol?

Since ethanol is used to oxygenate the gasoline mixture, which in turn allows the fuel to burn more completely and therefore produce cleaner emissions, its use in fuel has obvious benefits for air quality. Compared with conventional unleaded gasoline, ethanol is a particulate-free burning fuel source that combusts with oxygen to form carbon dioxide, water and aldehydes. Gasoline produces 2.44 CO2 equivalent kg/l and ethanol 1.94. However, Ethanol consumption in an engine is approximately 51% higher than for gasoline since the energy per unit volume of ethanol is 34% lower than for gasoline.

Ethanol in Indian context:

The Government of India in October 2007 decided to make 5% ethanol blending (with petrol) mandatory. Discussions are ongoing to increase the blending of ethanol to 10%. India stands to save a huge amount of foreign exchange through the blending programme, provided it gets ethanol at a viable price.

What is leaded petrol?

Gasoline, when used in high-compression internal combustion engines, has a tendency to autoignite causing “engine knocking”. The discovery that lead additives modified this behavior led to the widespread adoption of their use in the 1920s, and therefore more powerful, higher compression engines. The most popular additive was tetraethyllead. With the discovery of the extent of environmental and health damage caused by the lead, however, and the incompatibility of lead with catalytic converters, this practice began to wane and a few countries phased out using leaded petrol.

Banking bill, 2012

India is among the most-under banked nations among the world’s bigger economies. No Indian bank is among the top 20 banks in the world. According to economists, the narrow banking outreach will affect the economy more going ahead, as India moves into a decade where infrastructure financing will attract huge attention.

Positives:

- The provisions under the bill not only give the government’s ambitious financial inclusion plan more teeth, but also pave the way for large global banks to start operations in Asia’s third largest economy.

- The new Banking Bill passed by Parliament last week paves the way for state-owned banks to raise capital to expand their base through rights issues and issue of preferential or bonus shares without being limited by the earlier ceiling of Rs 3,000 crore.

- Capital infusion in these banks is done by the government on a periodical basis to ensure their growth and further expansion. But, with increase in their capital requirements over time, it has become important that these banks enter the capital market on their own. This will help reduce public funding of new social sector programmes and help ease pressure on the government’s constrained revenue flows, analysts opine.

- In cases of large scale fraud, the bill gives RBI the power to supercede the entire board of a bank. RBI will have greater flexibility in dealing with banks who crack up under fraudulent practices.

- The bill also enables government to raise shareholder voting rights in public sector banks to 10 per cent from 1 per cent now, acceding partially to foreign investor demands for a greater say in Indian banking. The Bill has increased the cap on voting rights for investors from 10 to 26 per cent in private sector banks

- In the case of foreign banks, the bill has accepted their longstanding demand to be allowed to convert their Indian operations into local subsidiaries, or transfer their shareholdings to a holding company of the bank with exemption granted on stamp duty. Currently, foreign banks pay 20-30 per cent tax on capital gains and stamp duty while transferring their branches to a new legal entity.

Fears:

- The bill will also sooner or later pave the way for consolidation in the banking space with the entry of some large players

- 10 per cent voting rights to private shareholders will mean that their voices will be heard 10 times more. Private shareholders will now demand more dividend and will be least concerned about fare utilization of public money.

- The bill has dropped a controversial clause which would have allowed banks to enter into forward trading (as our Banks do not yet possess expertise to do commodity future trading, and this leads to volatility in banking sector)

You can hear the debate on banking bill broadcasted on All India Radio by clicking here.

[http://www.youtube.com/watch?v=8jdSkSzuYvU&list=PL39D30132C5F055FE]

Definition of ‘Commodity Futures Contract’:

An agreement to buy or sell a set amount of a commodity at a predetermined price and date. Buyers use these to avoid the risks associated with the price fluctuations of the product or raw material, while sellers try to lock in a price for their products. Like in all financial markets, others use such contracts to gamble on price movements.